Who We Are

Crown Haven Code of Ethics

Our Mission

To ensure you spend less time worrying about your money and more time enjoying your life.

Our Vision

To be the last advisor you ever need.

Our Core Values

- Act with Integrity; we respect our unique position to impact your life.

- Plan with a Purpose; be transparent, stay true to our mission.

- Make it Personal; you deserve a custom-tailored solution.

- Under-Promise & Over-Deliver; we’ll never exaggerate & exceed your expectations.

- As a Client, You are Family; we treat you as our own.

- It’s more than money; it’s your life.

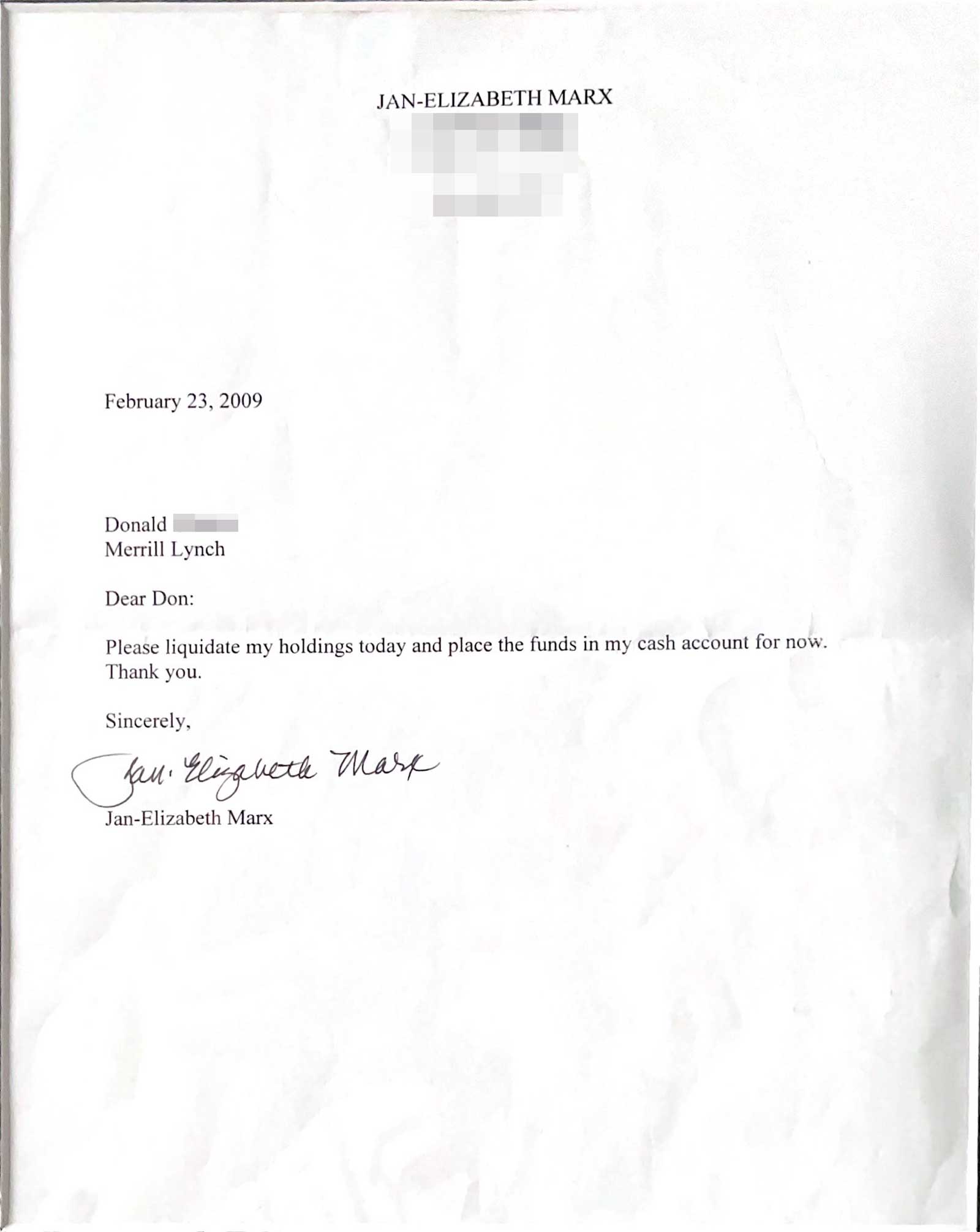

Casey Marx’s Mother’s Original Liquidation Letter

Casey Marx and his Mother

Our Origin Story

The financial crisis of ‘08/‘09 destroyed millions of family’s life savings, and Casey Marx’s (our founder) family was no exception.

The letter above stated Casey’s mother’s intention to divorce herself from her “advisor” at a “Big 5” broker/dealer and take back control of her financial future.

Casey’s dad had died when he was 15, and as an only child, he watched his mother lose more than half of her life savings within a blink of an eye – while the advisor was supposed to be minding the store.

At the time, Mr. Marx was in college pursuing a degree in medicine.

He didn’t intend on becoming a wealth advisor or retirement planner, but sometimes in life, your passion finds you.

Casey knew he wanted to prevent what happened to his mother from ever happening to her again, but when he began to look at the bigger picture, he realized she needed help with a lot more than just investing.

For instance, upon retirement, his mother was going to need to use her investments to replace her income she enjoyed from employment in a safe and sustainable way.

How would she accomplish this? What about taxes? How could she keep more of her hard-earned dollars to use for herself, now and in the future?

Making decisions about when to take social security and the options with her pension was a whole other conversation, and so was healthcare in retirement – she was terrified of getting sick and going broke.

What about her legacy? She wanted to make sure that her money went to the people she cares about, and her wishes were carried out properly.

When Mr. Marx examined the financial services industry and why it had failed his widowed mother, he was sick to his stomach.

The truth is that unless you are ‘ultra-high net worth’, most firms view it as a waste of time to offer additional guidance for these areas; there simply isn’t enough of a financial incentive to do so.

Meanwhile, if you’re a “normal person” the typical financial advisory firm simply wants to capture your assets and charge you a fee to invest your money (usually in the same thing they invest everyone else in).

The typical advisor’s goal is for your investments to perform on par with the market because so long as this is accomplished, they are in the clear from a regulatory standpoint and you typically won’t leave them.

This means that the end result of your relationship is that you ride the market and pay the advisor a fee whether you win or lose, while the advisor or firm creates more and more revenue by obtaining more accounts like yours, creating more passive residual income for the advisor (or firm).

There is no customization, there is no relationship, and there are no solutions offered for the many real needs you have.

The truth is that much of the financial advice industry is a fundamentally flawed sales system, and it’s sad.

The reason Crown Haven was founded is because we believe EVERYONE deserves great advice, from a team of expert professionals that truly care about your outcome.

That’s also why we created our registered RetireSHIELD® program, which is designed to eliminate threats and take advantage of opportunities in 5 key areas – the critical areas that ensure that you experience a life without financial stress – which allows for you to pursue your own version of happiness; whatever that means to you.

Serving as Trusted Advisors to Investors From Every Walk of Life

Since 2011, clients with greatly different financial needs and situations have come to Crown Haven looking for customized wealth management strategies to meet their unique needs.